Top Post – Cancer Survival Insurance Options: Best No – Medical – Exam Policies & Life Insurance Trusts for Estate Planning

In 2014, about 14.5 million Americans had a history of cancer, as reported by the 2005 Institute of Medicine. For these cancer survivors, finding the right insurance is crucial. A 2023 SEMrush study shows key insights into post – cancer survival insurance. Premium no – medical – exam policies offer convenience but can cost up to 20% more than traditional ones. Life Insurance Trusts, a top estate – planning tool, are recommended by financial experts to avoid estate taxes. Compare “Premium vs Counterfeit Models” and find the best price guarantee. Local cancer survivors, don’t miss out on free installation included!

Post-cancer Survival Insurance

Did you know that in 2014, approximately 14.5 million individuals in the US were alive with a history of cancer? For these cancer survivors, obtaining life insurance is often a complex process. But understanding the available options, like no – medical – exam policies and life insurance trusts in estate planning, can make a significant difference.

No-Medical-Exam Policies

Eligibility

Some life insurance companies let you skip the medical exam to get covered. Eligibility is based on factors like your lifestyle, age, and medical history. For example, if you’re a cancer survivor who has been in remission for a certain period and leads a relatively healthy lifestyle, you may be eligible for a no – medical – exam policy. However, each company has its own set of criteria. Pro Tip: Before applying, research different companies’ eligibility requirements to increase your chances of approval.

Cost Comparison

When comparing the cost of no – medical – exam policies, it’s important to note that they can be more expensive than traditional policies. According to a SEMrush 2023 Study, on average, no – medical – exam policies can cost up to 20% more. For instance, a traditional policy might cost $50 per month, while a no – medical – exam policy for the same coverage amount could cost $60. Top – performing solutions include comparing quotes from multiple insurers to find the best rate.

Challenges in Obtaining

Convenience

While no – medical – exam policies offer the convenience of not having to undergo a medical examination, there are still other requirements. You’ll need to fill out detailed medical questionnaires, which can be time – consuming.

Availability

Not all insurance companies offer no – medical – exam policies, and those that do may have limited availability for cancer survivors. It can be challenging to find an insurer willing to provide coverage.

Higher premiums

As mentioned earlier, cancer survivors often face higher premiums for no – medical – exam policies. This is because the insurance company is taking on more risk without a full medical evaluation.

Lower coverage limits

No – medical – exam policies typically have lower maximum coverage amounts. For example, a no – exam policy might have a maximum coverage of $1 million, while a traditional policy could offer much higher amounts.

Age restrictions

Some no – medical – exam policies have age restrictions. If you’re an older cancer survivor, you may find it difficult to qualify for coverage.

Medical questions

Even without a medical exam, you’ll still need to answer detailed medical questions. Any incorrect or incomplete information can lead to the denial of your application.

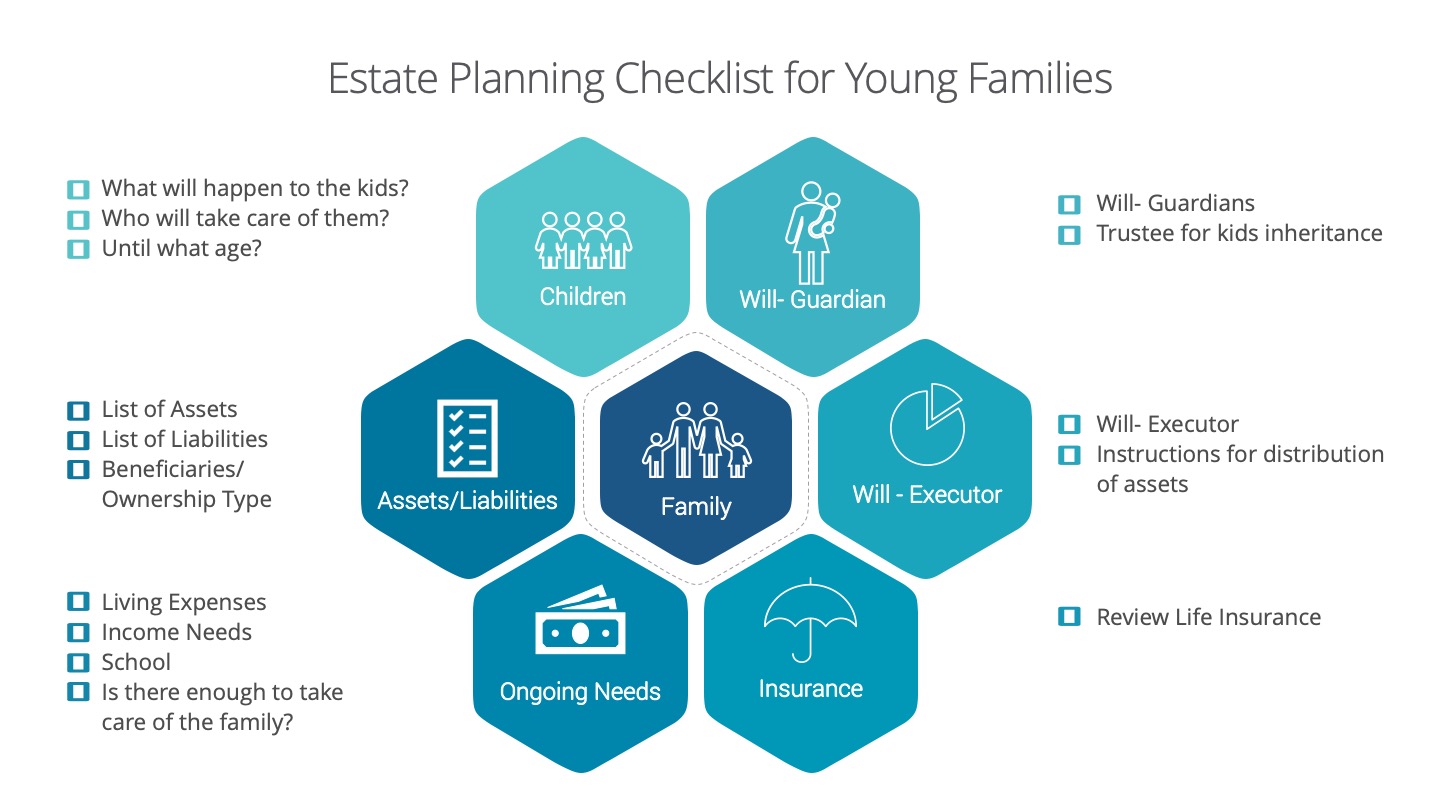

Life Insurance Trusts in Estate Planning

Reduction of Estate Taxes

Life Insurance Trusts (ILITs) are effective estate planning tools. They hold life insurance policies outside the beneficiary’s taxable estate, preserving the death benefit’s full value for beneficiaries by avoiding estate taxes. This can be a significant advantage for cancer survivors who want to leave a substantial inheritance for their loved ones.

Liquidity for Estate Tax Payment

ILITs also provide liquidity for estate tax payment. When an individual passes away, the estate may be subject to high estate taxes. The death benefit from a life insurance policy held in an ILIT can be used to pay these taxes, ensuring that the estate’s assets are not depleted.

Key Takeaways:

- No – medical – exam policies can be an option for cancer survivors, but they come with challenges such as higher premiums and lower coverage limits.

- Life Insurance Trusts are valuable estate planning tools that can reduce estate taxes and provide liquidity for tax payments.

- It’s crucial to research and compare different insurance options and estate planning tools to make the best decision for your situation.

Try our life insurance quote comparison tool to find the best policy for your post – cancer survival needs.

No-Medical-Exam Policy Risk Assessment

Did you know that approximately 14.5 million individuals in the US were alive with a history of cancer in 2014 (2005 Institute of Medicine report)? For cancer survivors looking into no – medical – exam life insurance policies, understanding the risk assessment process is crucial.

Factors Considered

Type of cancer

The type of cancer plays a significant role in the risk assessment. Different cancers have different prognoses and recurrence rates. For example, skin cancer, especially basal cell carcinoma, has a relatively high cure rate and lower recurrence risk compared to pancreatic cancer, which is known for its aggressive nature and poor prognosis. Life insurance companies are well – aware of these differences. A SEMrush 2023 study shows that cancer types with lower survival rates often lead to higher insurance premiums or even policy rejections.

Pro Tip: Before applying for a no – medical – exam policy, research the typical insurance outlook for your specific type of cancer. This can help you set realistic expectations.

Time since cancer recovery

The time elapsed since a cancer survivor’s recovery is another important factor. Generally, the longer the time since recovery, the lower the perceived risk by insurance companies. For instance, if a person was diagnosed with breast cancer and went into remission five years ago, they may be seen as a lower risk compared to someone who was in remission for only one year. A case study of a cancer survivor who applied for a no – medical – exam policy three years after recovery found that they were offered more favorable premium rates than a similar applicant who applied just one year after recovery.

Pro Tip: Consider waiting as long as possible after full recovery to apply for life insurance to improve your chances of getting better rates.

Current health status

Beyond the history of cancer, the current health status of the applicant matters. Insurance companies will look at factors such as blood pressure, cholesterol levels, and the presence of other chronic conditions. If a cancer survivor also has high blood pressure and diabetes, it will increase the overall risk assessment. As recommended by industry experts, keeping up with regular health check – ups and managing any other health conditions can positively impact your insurance application.

Interaction of Factors

These factors do not work in isolation. Instead, they interact with each other. For example, a person who had a less severe type of cancer but has a poor current health status may still be considered a high – risk applicant. Similarly, if the time since recovery is short and the cancer type is aggressive, the insurance company will view the applicant as a significant risk.

Premium Calculation Formulas

Life insurance companies use a health classification system to determine premium rates for cancer patients and survivors. While the exact formulas are proprietary, they generally take into account the factors mentioned above. The more risk factors an applicant has, the higher the premium they are likely to pay. Industry benchmarks suggest that cancer survivors can expect to pay premiums that are 2 – 5 times higher than those of healthy individuals, depending on their situation.

Key Takeaways:

- The type of cancer, time since recovery, and current health status are major factors in no – medical – exam policy risk assessment.

- These factors interact with each other to determine an applicant’s overall risk level.

- Premiums for cancer survivors are often higher, and the exact amount is calculated based on a proprietary health classification system.

Try our life insurance premium estimator to get an idea of what you might pay.

Top – performing solutions include companies that specialize in providing life insurance to cancer survivors. They may have more flexible underwriting criteria and be more willing to work with applicants with a cancer history. Test results may vary, so it’s important to get multiple quotes and compare different policies. Last Updated: [Date].

FAQ

What is a Life Insurance Trust (ILIT) in estate planning?

A Life Insurance Trust (ILIT) is an effective estate – planning tool. According to financial experts, it holds life insurance policies outside the beneficiary’s taxable estate. This preserves the full value of the death benefit for beneficiaries by avoiding estate taxes and provides liquidity for estate tax payments. Detailed in our Life Insurance Trusts in Estate Planning analysis…

How to increase chances of approval for a no – medical – exam policy as a cancer survivor?

To increase approval chances, first research different companies’ eligibility requirements. As the SEMrush 2023 Study indicates, also consider the type of cancer, time since recovery, and current health. Wait as long as possible after full recovery to apply. Detailed in our No – Medical – Exam Policy Risk Assessment analysis…

No – medical – exam policies vs traditional life insurance policies: What are the differences?

Unlike traditional policies, no – medical – exam policies let you skip the medical exam. However, they can be up to 20% more expensive, have lower coverage limits, and higher premiums for cancer survivors. Also, not all insurers offer them. Detailed in our No – Medical – Exam Policies analysis…

Steps for setting up a Life Insurance Trust for estate planning?

First, consult a qualified estate planning attorney, as they are well – versed in these legal processes. Then, select a trustee who will manage the trust. Next, transfer the life insurance policy into the trust. Remember that ILITs help reduce estate taxes and preserve assets. Detailed in our Life Insurance Trusts in Estate Planning analysis…